Book a demo today Schedule a time →

Your AI Desk for Insurance

POLICYCHECK

POLICYCHECKLive, accurate, adviser-approved policies — from discovery to documentation, all in one seamless flow.

LISTENER

Smart Client Discovery

Capture needs with precision. Real-time prompts ensure every detail is covered and every requirement is understood.

ANALYST

AI Policy Matching

Instantly compare thousands of policies and variations. Highlight what changes, what matters, and what’s best for the client.

ADVISOR

Statements & Client-Ready Docs

Draft Statements of Advice, proposals, and compliant communications — fast, accurate, and fully explainable.

Six tools, one login

Drag and drop your client data, transcripts, emails, claims, and policies for a full picture.

We pre-fill proposals & quotes

We take the conversation and turn it into usable drafts you can review.

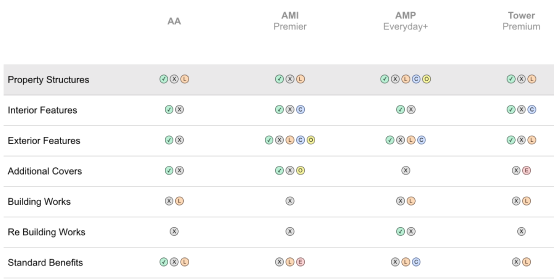

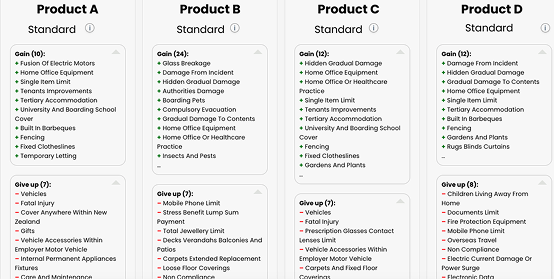

We compare policies instantly

Compare A with B for gain or give up — compare endorsements with base policies, instantly.

COMPARE POLICIES

Compare policies, explain coverage in plain English, create client-ready documents, and collaborate with carriers—faster and with total confidence.

Word-for-Word Policy Diff

See exact wording changes between carriers at clause/line level.

Endorsement vs Base Comparison

Redline endorsements against the master wording to show what changed.

Policy Version Timeline

Track every change across drafts with time-stamped diffs.

Exclusion Heatmap

Visualize exclusions against the client’s risk profile and sector.

Coverage Spider Charts

Radar charts compare breadth/depth of coverage between two policies.

Limits & Deductibles Matrix

Side-by-side matrix for limits, deductibles and aggregates.

Sub-limit Finder

Automatically surfaces hidden sub-limits and inner limits.

Conditions & Warranties Detector

Flags restrictive warranties and onerous obligations.

What’s Not Covered

Plain-English summary of gaps, exclusions and grey areas.

AI Policy Explanations

Client-friendly explanations with clause citations for trust.

Inline Comments & Tasks

@mention colleagues; resolve threads per clause.

Secure Share Links

Watermark, expiry and read-receipts for client deliverables.

Dynamic Scenario Testing

Toggle limits, deductibles and endorsements to model price/coverage.

Clause Library & Precedents

Curated, searchable library with firm-preferred wording.

Risk Data Enrichment

Geo, catastrophe and cyber signals layered onto client data.

Visual Gap Map

Clear overlays showing uncovered vs partly covered areas.

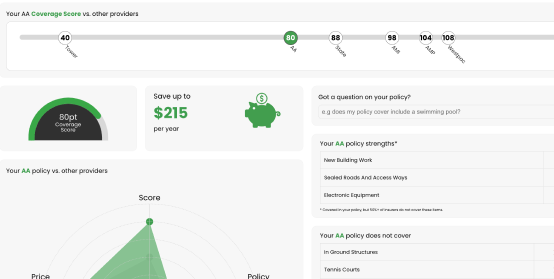

Policy Rating Score

Weighted scorecard for clarity, breadth and claims behavior.

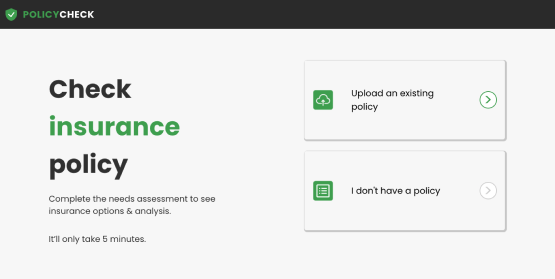

Streamline the client onboarding process

Easily capture and digitize client needs, ensuring a comprehensive understanding of their requirements right from the start.

Learn more...

AI-Driven policy matching

Leverage the power of AI to match your clients with the best policies based on their unique needs.

Learn more...

Effortless side-by-side comparisons

Compare policies with ease, highlighting key differences to help clients make informed decisions.

Learn more...

Seamless & compliant communication

Enhance client interactions with streamlined communication tools that keep everything compliant and on record.

Learn more...

Supported Policies

- Homeowners Insurance

- Renters Insurance

- Landlord Insurance

- Flood Insurance

- Auto Insurance

- Motorcycle Insurance

- Boat Insurance

- RV Insurance

- Term Life Insurance

- Universal Life Insurance

- Accidental Death Insurance

- Individual Health Insurance

- Family Health Insurance

- Dental Insurance

- Vision Insurance

- Short-term Disability

- Long-term Disability

- Critical Illness Insurance

- Income Protection

- Trip Cancellation

- Medical Evacuation

- Baggage Loss

- Travel Delay

- Accident and Illness Coverage

- Routine Care Coverage

- Hereditary Condition Coverage

- Emergency Care

- Personal Liability Coverage

- Property Damage Liability

- Legal Defense Costs

- Worldwide Coverage

- General Liability Insurance

- Commercial Property Insurance

- Business Interruption Insurance

- Product Liability Insurance

- Medical Expenses Coverage

- Lost Wages Coverage

- Disability Benefits

- Employer Liability

- General Liability

- Product Liability

- Public Liability

- Employers Liability

- Errors and Omissions

- Malpractice Insurance

- Directors and Officers

- Fiduciary Liability

- Data Breach Coverage

- Network Security Liability

- Cyber Extortion

- Business Interruption

- Crop Insurance

- Livestock Insurance

- Farm Equipment Insurance

- Farm Liability Insurance

- Cargo Insurance

- Hull Insurance

- Marine Liability Insurance

- Freight Insurance

- Aircraft Hull Insurance

- Passenger Liability

- Public Liability

- Ground Risk Hull Insurance

- Trade Credit Insurance

- Surety Bonds

- Fidelity Bonds

- Performance Bonds

- Building Property Coverage

- Personal Property Coverage

- Replacement Cost Coverage

- Cleanup and Debris Removal

- Proportional Reinsurance

- Non-proportional Reinsurance

- Catastrophe Bonds

- Retrocession

- Event Insurance

- Kidnap and Ransom Insurance

- Fine Arts Insurance

- Jewelry Insurance

The AI Desk Built for Enterprise Advisory Teams

PolicyCheck brings your entire advice process into one AI-powered platform — from discovery and policy intelligence to drafting, oversight, and compliance. Every policy stays live, accurate, and adviser-approved, giving your teams unmatched speed and clarity across thousands of clients.